L.M. Kohn is an independent, family-owned, hybrid Registered Investment Adviser (RIA) and Broker-Dealer founded by a financial advisor who was unhappy with the Broker-Dealer and insurance company platforms available in 1990. He wanted to build his dream practice to better serve his clients and created his own Broker-Dealer to do so. Over the last 3 decades, the firm’s advisor base has grown organically through referrals from our affiliates, word of mouth, and others who simply heard of us in other ways.

Our goal is to help other financial advisors who are tired of the current options, are tired of repapering their accounts, are tired of not being in control, are tired of being one of thousands where nobody knows your name, and who are tired of drowning in excessive costs and fees charged by their firm that eats into the bottom line.

We want to help financial advisors build their dream practices cost effectively, using the products and services they believe in, and without the fear of ever having to repaper again.

L.M. Kohn advisors are encouraged to build their own brand to highlight their own expertise. We want you to build your practice to fit your lifestyle and the clients you love to serve. You should not have to spend any more money than necessary for non-revenue generating expenses, while knowing exactly what you’re paying for and why. We want you to have access to cutting edge client facing tools, operations, and marketing technology. Additionally, our staff is friendly, knowledgeable, and experienced. Not only will our staff know you on a first name basis and vice versa, but our management team prides itself on being so accessible that you can reach them on their cell phones on the weekends. Further, our advisors love our compliance department because we are collaborative rather than combative. Our compliance team works with you – not against you. If it can be done compliantly, we’ll help you figure out how. Lastly, you will never have to worry about re-papering due to a sale or merger, as we have succession planning in place to ensure the longevity of the firm for many years to come.

Build your own brand. No requirements to use specific products or platforms. Choose your mix of fee-based, brokerage, and insurance. Work with the people you want to help. No account minimums, no production minimums, or sales quotas. You’re in control to build your practice the way you want it.

This is a family business with a management team committed for decades to come. No future merger = no future repapering. Our compliance record speaks for itself; we protect our advisors by shielding them from bad actors and products. When you join L.M. Kohn, this will be your “Last Home.”

We strive to keep costs to our advisors as low as possible without sacrificing value. You’ll know what you’re paying and why. We are always cognizant of fees and the effect that they have on your bottom line. We don’t hide fees and we aren’t going to nickel and dime you to make it appear you’re paying less than you really are.

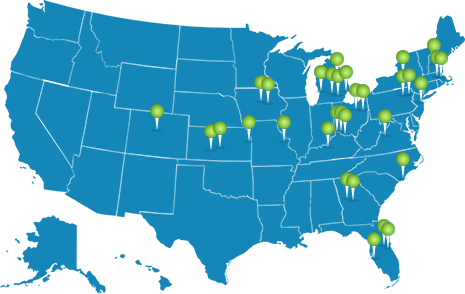

While headquartered in Cincinnati, Ohio, L.M. Kohn advisors can be found all across the country. Most have established their own brand, while others do business under the L.M. Kohn brand. Our open architecture platform allows advisors to build their dream practice on their own terms. We have an experienced advisor base with over a third of them having 30+ years in the industry. We have helped many retiring advisors find suitable partners for succession and assisted in a smooth transition from the sale of a practice to an exit strategy. Feel free to search through our advisor directory and get to know our affiliated advisors by visiting their websites or even reaching out and connecting.

Hello! I’m Larry Kohn. I founded L.M. Kohn as my dream practice back in 1990. I was unhappy with the limited options available to me at the time, so I created my own Broker-Dealer to have the freedom to run my practice the way I wanted. Back then, I knew that fee-based products would be a big part of the future. Thus, our platform developed and grew with the establishment of the Registered Investment Adviser (RIA) firm with cutting edge fee-based products. Along the way, other unhappy financial advisors took notice that they could build their dream practice at my firm and asked to join us. While I built L.M. Kohn for me, our platform has empowered many other advisors to have the freedom to build their own dream practice. The future vision of the company continues to be centered around that concept.